Mortgage Rate Update – Waiting for the 2nd Half

April 12, 2023

Mortgage Rate Update – Know Pain, No Gain

July 12, 2023Today, the Bank of Canada (BOC) Governor, Tiff Macklem, decided to raise the prime rate by 25 basis points, and it’s making waves. With little economic data to back it up, Governor Tiff took the plunge, claiming a strong first quarter, especially in the service sector and housing. It seems he’s not ready to call it quits just yet.

It’s surprising that he feels this way given that globally consumer price inflation is slowing, growth has stalled in Europe, China is showing signs of slowing and energy prices are coming down. It almost seems as if the Governor who waited too long to raise rates back in early 2022, ironically will now be known for not stopping sooner.

So, where does this leave us?

According to CIBC economist Benjamin Tal, every time a central bank tightens interest rates in an effort to slow the economy, a recession follows. It looks like today’s actions have put us on that path.

But here’s the counterintuitive good news: a recession can actually be beneficial for mortgage rates. How? Well, when a recession hits, inflation falls, and bond yields drop. Both of these factors contribute to lower mortgage rates.

But wait, if a recession seems likely, why are mortgage rates on the rise?

Currently, the rise in interest rates can be attributed mainly to the lack of clarity surrounding the economy’s direction. When big investors are uncertain about the potential for increased inflation or lack confidence in the US economy due to recent debt ceiling negotiations, they tend to shift their investments from bonds to cash, waiting for clearer signals. As a result, bond yields increase, leading to higher costs for banks to fund mortgages.

So, when can we expect rates to change?

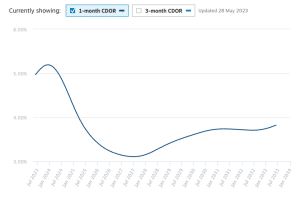

We’ll need to see a quarter of negative growth to set the stage. While a recession is technically defined as two consecutive quarters of negative growth, investors will try to anticipate the upcoming lower rate environment and jump back into the bond market. According to the BOC’s press release, they anticipate the economy to slow down in August/September of this year. Once we see this shift, mortgage rates should soon follow suit. We expect the recent increase in fixed mortgage rates to reverse next month, and the summer may mark the beginning of a gradual decline in rates. You can refer to the chart from Chatham Financial for a consensus on where rates will be in the next two to four years.

So, which mortgage term should you choose?

As of writing this post, we recommend opting for shorter-term mortgages or, in some cases, variable rate mortgages. As of now, the 3-year fixed term strikes the right balance between cost and security from future increases. Additionally, some institutions we have access to are offering cash bonuses on funding or free legal services for switching over. However, keep in mind that mortgage terms are not a one-size-fits-all solution. It’s crucial to have a conversation to assess your current budget and future needs, making sure you select the right term and lender.

The reality of our current rate environment is that a large portion of Canadians have a mortgage rate that are below 3%. Until those mortgages start maturing, household budgets will have room to spend money, which will keep Governor Tiff scratching his head wondering what to do. We can only hope that the BOC scare tactics keep the consumer’s wallet closed and in their pockets over the coming months.

That’s all for this update, but if you have a maturing mortgage, are considering buying a home, or simply unsure about your mortgage situation, you can reach to us by completing the contact form on our homepage. We usually respond within an hour.

People often comment when we finish a call, they can’t believe the clarity 15-minute conversation can provide.

Until the next update …

The next Bank of Canada meeting is July 12th, 2023

Did you Like this post? Then you’ll Like my Facebook Page. It’s filled with current news on what’s going on in the world of real estate.