Treading Water: What the Bank of Canada’s Hold Means for Your Mortgage ( and your job )

June 4, 2025

Rate Update: Why Today’s Cut Could Shift the Market

September 17, 2025July 30, 2025

As expected, Governor Tiff Macklem held the overnight rate steady, meaning the prime rate will remain at 4.95%. This marks the third consecutive pause after seven cuts earlier this year. While many were hoping for another drop, inflation data and global trade drama are keeping the Bank cautious.

Inflation remains close to the Bank’s 2% target, but underlying price pressures—particularly for non-energy goods—are still a concern. On top of that, the unpredictable impact of U.S. tariffs has added new costs and uncertainty to our economy, especially in export-heavy sectors.

What’s driving the decision to keep the prime rate the same?

Inflation remains close to the Bank’s 2% target, but underlying price pressures—particularly for non-energy goods—are still a concern. On top of that, the unpredictable impact of U.S. tariffs has added new costs and uncertainty to our economy, especially in export-heavy sectors.

Now for the good news:

Canada’s economy is showing resilience. Unemployment remains relatively low, and despite a tariff-fueled slowdown in exports to the U.S., other sectors are picking up the slack. Governor Tiff hinted it might cut rates once more this year if the economy slows as expected in Q2 and Q3.

So how is this impacting real estate in North Vancouver?

For the North Vancouver market, sales have slowed, but listings have increased. Buyer and seller sentiment still remain positive, and we still have a steady stream of new inquiries coming to us from our referral sources. The issue is that 1st time buyers feel time is on their side and are in no rush to buy, which is creating a logjam effect in the market. However, our existing clients who are upgrading can see the opportunity that this market is presenting and are willing to sacrifice not getting top dollar on the sale of their existing home, knowing they will more than make up for it on the purchase of their new home. Because of that, we have seen an uptick in activity in the past few weeks in the $1.8 to $2.6 million section of the market.

When are the rate drops coming? If at all!!

Tiff and company once again talked about the crossroads the Canadian economy is at. Each path has a very different outcome for inflation, and because of that, a different action is required on Tiff’s part. So once again, we are stuck waiting for the data to arrive before the Bank of Canada makes a policy change.

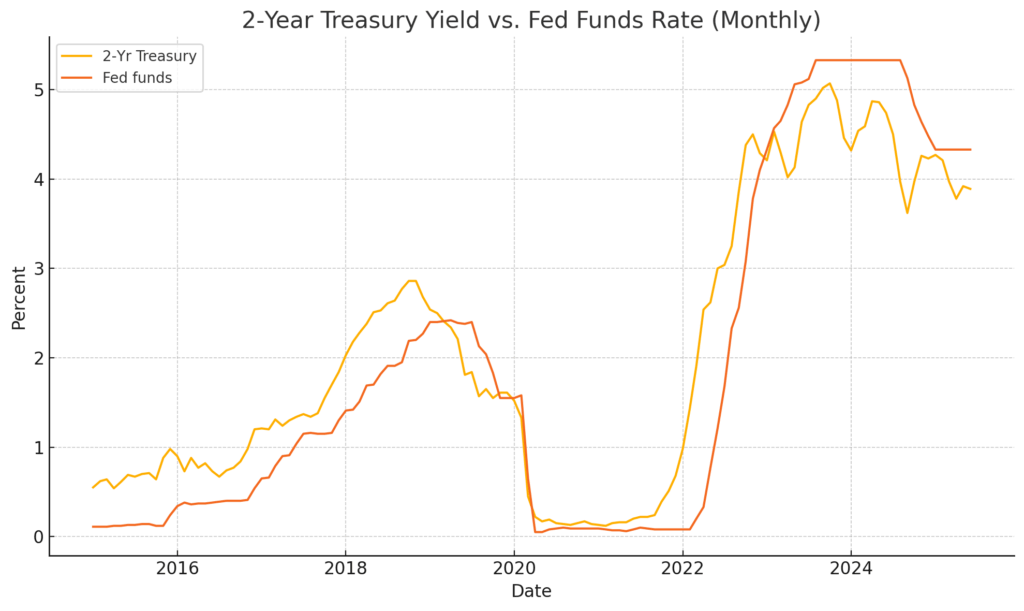

But there’s a glimmer of hope on the horizon—and it comes from the U.S. bond market. Looking at the chart below, you can see how historically, the 2-year Treasury yield has acted like a crystal ball for central bank policy, often signalling rate changes 4 to 6 months before the Federal Reserve makes its move. Right now, that yield is sitting below the Fed’s current policy rate, a strong indication that monetary easing may not be far off. If the Fed takes the hint and cuts rates in the coming months, it could relieve pressure on global bond yields—potentially bringing down fixed mortgage rates here in Canada, too.

What to do with your mortgage:

With the path to lower fixed and prime rates still remaining elusive, and some lenders increasing rates this week, we are continuing our recommendation of going with a 3-year fixed rate mortgage, which provides the best combination of reward while minimizing rate risk. The key to this strategy is having a flexible mortgage product that will allow you to access lower rates should they arrive prior to your mortgage maturity date. As always, give us a call if you have a financing decision to make. We can help you navigate this rate environment in the context of your financial situation AND life goals. A word of advice in this intense rate advertising environment. Don’t get caught chasing a lower rate without factoring the mortgage product into your decision. It’s a recipe for being stuck on “high interest rate island” – alone and hoping for a passing ship to come rescue you.

And that’s it for this update. Since the next meeting is not scheduled until the end of September, I’ll take this opportunity to wish you all a wonderful summer and hope you manage to find time with family, friends and take time to enjoy this beautiful city we call home!

The next Bank of Canada meeting is September 17th, 2025

Did you Like this post? Follow me on Instagram or Facebook! My feed is filled with current news and where I share my ideas on how to get where you want to go in real estate.